Introduction

Want to retire early? This app tells you how long it will take.

At a high level, step one is to figure out how much you need to save and step two is to figure out how long it'll take to reach that amount of savings.

If you're already familiar with this stuff, check out the condensed page. If not, this page will walk you through things more slowly.

Well, it'll get you in the right ballpark. If you're like me, the right ballpark is good enough. I'd prefer to not have to think about dozens of parameters like interest rates and inflation. If you do need more precision I'd recommend checking out ProjectionLab.

What if you're not planning to retire early? You plan to retire at a normal age but still want to use this tool? Well, you can. Things get a little more imprecise as you get further from retirement though. Just make a mental note of that and take the results with an appropriate grain of salt.

Safe Withdrawal Rate

I'd like to introduce a term: the Safe Withdrawal Rate (SWR). Suppose you have a $1M nest egg. A SWR of 4% would mean that if you withdrew 4% of your nest egg each year — $40k — it'd last forever. The interest it generates would offset the money you take out.

That begs the question of what the SWR is. The short answer to that question is 4%.

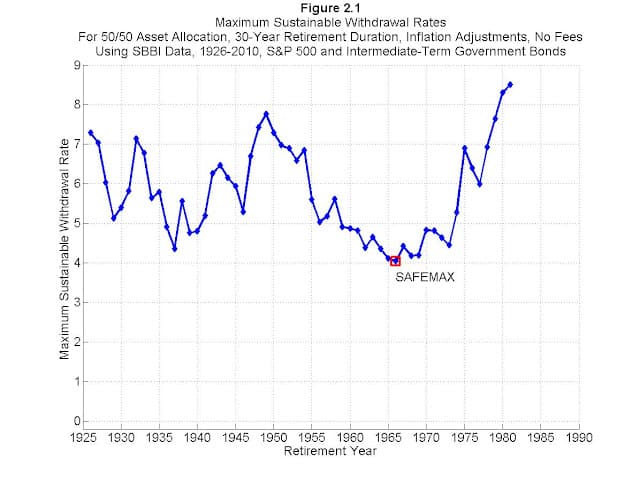

Here is a longer answer to that question. In 1998 there was a paper by three professors of finance at Trinity University. This paper is known as the Trinity Study. They asked the question: if you retired in 1926, what would the SWR be? What about 1927? 1928? 1929? So on and so forth up until 1981. The answers depend on things like stock market performance and inflation, but have always ranged from 4-8.5%.

What would you like to use for your withdrawal rate? Think about how aggressive or conservative you want to be. 4% is conservative, 7% is aggressive.

The numbers can go past the range of the slider. Ie. the slider has a max of 8 but if you type in the input field directly it can go up to 20.

Mr. Money Mustache has a great blog post on safe withdrawal rates.

The math works out to be pretty nifty. At a 4% SWR you can multiply your yearly spending by 25 to get the size of the nest egg you'll need. At 5% you multiply by 20. More generally, you multiply by 100 / SWR.

Note that the Trinity Study took place between 1926 and 2010. Do you expect 2010 to 2094 to look much different? Also note that there are criticisms of the Trinity Study.

On the other hand, note that in practice you can be flexible. If you retire early and your nest egg is looking a little small you can always earn some side income, decrease your spending, or in an extreme scenario return temporarily to full-time work. See It's All About the Safety Margin.

Nest Egg

Now that we have your withdrawal rate we're quite close to figuring out how big of a nest egg you need. We'll approach it with the following two questions:

- How much do you spend per month? Think: rent, groceries, etc.

- How much do you spend on top of that every year? Think: vacations, medical, miscellaneous, etc.

To be clear, the question at hand is how much you're planning on spending once you're retired, not what you're spending right now. You might spend less during retirement because eg. you have more time to cook. Or you might spend more because you want to indulge in travel and hobbies.

Note sure how much you spend? I'd highly recommend tracking your spending. If you aren't currently doing so, the actual numbers might surprise you.

- Personally I use a minimal and lightweight app called GreenBooks.

- The more popular alternative is Mint. Mint categorizes things automatically but I don't like worrying that it got something wrong. What if your trip to Target was for

groceriesinstead ofhousehold? - You Need A Budget is another popular alternative.

Yes, life is full of surprises, but once you have a few years of data on how much you spend I think that plus some common sense gives you a pretty good idea of what you'll need during retirement.

With the three parameters we've entered in so far, we can compute two useful results:

- Total yearly spending

- $35,000

- Retirement target (nest egg)

- $875,000

If you're extra conservative, you may want to add a little buffer to your retirement target. Ie. maybe you want to add an extra $50k to the previous result to provide additional breathing rooom. You can do so below.

Years Until Retirement

Cool. We know that you are targeting a $875,000 nest egg. The question now becomes: how long will it take to get there?

In the spirit of keeping things simple and accepting results that are in the right ballpark, let's take an easy approach to answering this question.

How much do you currently have saved up?

Awesome. That means that you need $575,000 more to retire.

Now, how much do you think you can save each year?

And how much interest do you expect it to generate each year?

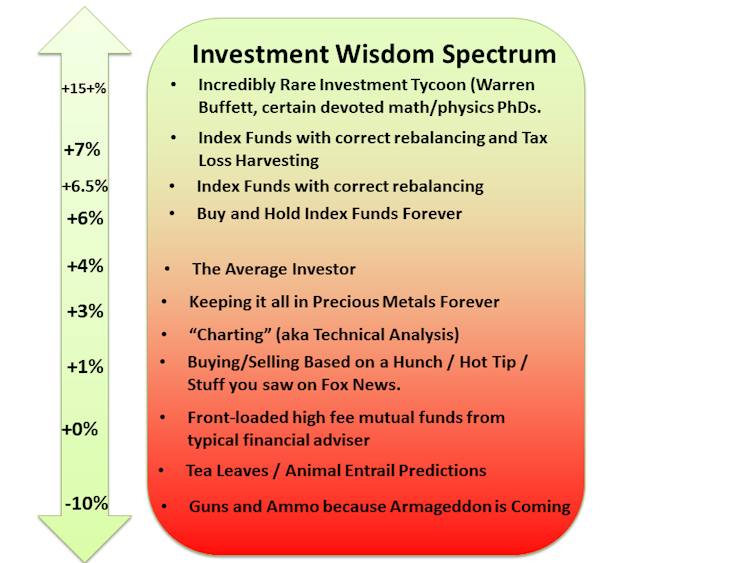

You probably want to use something like 5-7%. From Mr. Money Mustache's post Why I Put My Last $100,000 into Betterment:

With these three values we can now get our final answer of...

- Years until retirement

- 7.33

Condensed page

Congratulations, you made it through!

At this point you probably want to play around with the numbers some more. For that, I'd recommend heading over to the condensed page. It's easier to play around with the numbers on that page. It also has a cool feature where you could compare stuff to a baseline and set a new baseline. Check it out.

Wrapping Up

I hope you enjoyed using this tool. If you did it'd be great if you shared it with your friends. If you're interested in early retirement I'd recommend Mr. Money Mustache. If you have any questions or comments, shoot me an email. You can also buy me a coffee or check out the code on GitHub.

Cheers! 👋